Supporting Employees During National Infertility Awareness Week and Beyond

National Infertility Awareness Week (April 21-27, 2025) serves as a powerful reminder of the challenges faced by the 1 in 6 couples struggling with infertility in the United States. This week-long observance, established by RESOLVE: The National Infertility Association, aims to raise awareness, encourage open discussion, and promote understanding of reproductive health issues that affect millions of Americans. This year’s theme, “You Are Not Alone,” emphasizes the importance of community support and accessible resources for those navigating infertility. For benefits decision-makers, National Infertility Awareness Week presents a timely opportunity to evaluate how your benefits package addresses these needs and demonstrates

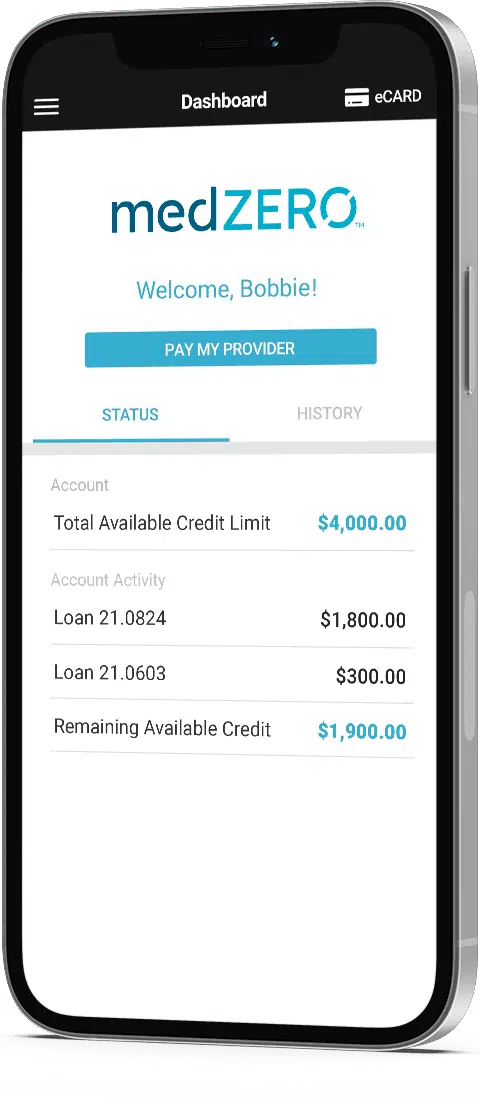

The medZERO support preson was so helpful walking me through the processs and answering all my questions!

The medZERO support preson was so helpful walking me through the processs and answering all my questions!  I needed new glasses to pass my drivers license test, without medZERO I would not have been able to afford them.

I needed new glasses to pass my drivers license test, without medZERO I would not have been able to afford them.  The hospital wanted me to pay for my surgery up-front. I used medZERO and was able to have my surgery. I don't know what I would have done without medZERO. Thank You!

The hospital wanted me to pay for my surgery up-front. I used medZERO and was able to have my surgery. I don't know what I would have done without medZERO. Thank You!